In a move that could finally end a half century-long saga and mark a major step forward for Chinese infrastructure builders in Colombia, city authorities chose two Chinese companies to build the first line of the Bogotá metro, starting in 2020.

Successive plans to build the Bogotá metro have been announced over the years, only to collapse later on. Its citizens talk about it in mythical terms, rather than as a feasible project. While cities similar in size such as Lima built theirs, the Colombian capital stood out as one of the largest cities in the world not to have a metro system.

In the end, the Chinese APCA Transmimetro consortium competed with a single rival and presented a winning bid of 13.8 trillion pesos (US$4.5 billion). However, its constituent companies have little experience building metro systems and have been plagued by scandals elsewhere in the world.

The Chinese consortium

APCA Transmimetro consists of two Chinese state-owned companies. China Harbour Engineering Company Limited (CHEC) controls 85% and Xi’an Metro Company Limited 15%.

The consortium was one of five finalists announced in August. Only two submitted bids in the final tendering stage that closed two weeks ago amid concerns from some bidders about high costs required by the city and difficulties accessing finance.

Although the final decision was scheduled for Monday October 21, Mayor Enrique Peñalosa’s city government unexpectedly brought the date forward and chose the Chinese consortium over that led by Carso Infraestructura y Construcción, which Mexican mogul Carlos Slim, the world’s fifth richest man, owns.

24km

the total length of the Bogotá metro line

The elevated Bogotá metro line, which includes 23.96km of overpass and 16 stations, will run through the city from south to north. The mayor estimates that it will transport 72,000 passengers per hour, helping ease the existing pressure on the Transmilenio bus rapid transit (BRT) system that Peñalosa inaugurated during his first stint as mayor (1998-2001) but which can no longer support demand.

Main APCA partner CHEC is a subsidiary of the state-owned infrastructure giant China Communications Construction Company (CCCC), which has a global portfolio and ranks 110th in Forbes’ list of the world’s 500 largest companies.

The smaller is a company from Shaanxi Province that operates mainly in China and was responsible for the construction and operation of the metro in Xi’an, the city of 7 million that is perhaps most famous for being home to the terracotta army that adorns the first Chinese emperor’s mausoleum.

Neither of the two Chinese companies has participated in metro or rail projects in Latin America.

CHEC’s step forward

Unlike most of its Andean neighbours, Colombia has shied away from joining China’s Belt and Road infrastructure initiative and granted few big infrastructure contracts to Chinese companies.

However, CHEC is currently building a 30-kilometre portion of the highway connecting second city Medellín with the Caribbean coast.

Elsewhere in Latin America, CHEC has constructed several road and port projects, but few mass transportation systems.

In Costa Rica, CHEC oversees the extension of Route 32 between capital San José and the Caribbean port of Limón, works financed by a US$395 million loan from China’s Eximbank. The project was slated for completion by the end of 2020, although the government recognises it will take longer.

According to national La Nación, 20% of the workers hired by CHEC come from China.

In Panama, the Chinese company is part of a consortium building a cruise port in the Pacific and a bridge over the Panama Canal. However, weeks ago the Panamanian National Assembly’s public infrastructure commission announced it had found irregularities in the award of the contract, delaying work.

In other countries, some CHEC projects have failed to materialise, including in Mexico, where discussions with former president Enrique Peña Nieto’s government about a port in the city of Guaymas, Sonora state, didn’t advance.

In Peru, it has promoted a new port at the southern city of Ilo that would cost around US$300 million, in addition to a railroad that would connect it with the city of Santa Cruz in Bolivia and the Brazilian state of Mato Grosso.

CHEC’s Metro

CHEC’s only experience constructing metros seems to be in Mumbai, India. In April last year, CHEC and Indian company Tata Projects Limited won the tender to build two sections of Mumbai’s fourth subway line. It is a 12.5 kilometre stretch comprising 14 stations that, like the Bogotá metro plans, is elevated and passes over densely populated areas.

However, CHEC is perhaps best known as the main backer of some of the largest projects in Sri Lanka, two of which have been controversial.

The first is the port of Hambantota in the south of the island, which CHEC built and has operated below capacity since it was inaugurated. As Sri Lanka’s government struggled to repay the credit Chinese banks had provided, it handed over control to the Chinese government, which some observers see as proof of the onerous conditions of its lending model.

“This case is one of the clearest examples of China’s ambitious use of loans and cooperation resources to gain influence around the world – and also of its willingness to be tough at the time of charging money,” the New York Times wrote about the port last year.

The second CHEC project is the Colombo International Financial City, an ambitious new urban centre that, as reported by China Dialogue, the Sri Lankan government describes as “its own Hong Kong”, in reference to its desired function as a regional financial centre to rival Dubai and Singapore.

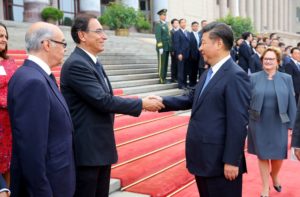

The megaproject, which would double the Sri Lankan capital’s 700,000 inhabitants when completed by 2041, would bring an estimated US$1.4 trillion in foreign direct investment and was publicly backed Chinese president, Xi Jinping, who travelled to the island as construction began.

Yet it has roused considerable controversy. It sits on reclaimed land in the Indian Ocean and implies dredging that would cause coastal erosion and decrease fish populations, environmentalists and fishers say.

Current Prime Minister, Ranil Wickremesinghe, campaigned against the project and suspended it for five months, before changing its name and proceeding.

Enabled by preferential credit from China Eximbank, CHEC is also building one of the four sections of the Southern Expressway, the highway that will link Hambantota with Colombo.

Xi’an metro scandal

Nor has APCA minority partner Xi’an Metro Company avoided controversy.

In March 2017, it was involved in a scandal after insider reports emerged of the company using lower quality cables than regulations permit. Xi’an had bought them from Shaanxi Aokai Cable Company, where the whistleblower worked.

Several executives from the construction company were sanctioned, including senior executive Chen Dongshan, who was sentenced to ten years in prison for receiving a bribe of 5 million yuan (US $700,000).

The ruling stipulated that Chen had also profited from his position as head of the company to aquire goods worth a total 44 million yuan (US$6 million dollars) between 2008 and 2013, which included a 50,000 euro payment, two watches and a Chinese calligraphy work, all linked to construction of the Xi’an metro. A Shaanxi Aokai Cable representative was handed life imprisonment.

APCA, the eventual winner of the Bogotá metro contract, weren’t the only Chinese bidders.

One of the three consortia that did not submit final bids included Power China International Group Limited and another consortium led by China Railway Group Limited. The latter was disqualified during the initial phases after it appeared in the World Bank’s list of companies sanctioned in September following fraudulent practices at the Dasu hydroelectric plant in Pakistan.

![Huge amounts of electricity are created in Kinnaur, but most villages have to deal with extended power cuts [image by: Subrat Kumar Sahu]](https://dialogue.earth/content/uploads/2019/03/electricity-300x169.png)

![CO2 emissions by type of coal plant [Source: NRDC]](https://dialogue.earth/content/uploads/2019/03/graph4_cropped-300x183.png)