Acute energy shortages has been one of South Asia’s major challenges. And given the distribution of natural resources, regional electricity trade has long been touted as the obvious solution. This has been a hot topic at regional forums in South Asia including the South Asian Association for Regional Cooperation (SAARC) and the Bangladesh, Bhutan, India, Nepal Initiative (BBIN).

How should Nepal develop its hydropower resources?

Opinion is split on how Nepal should develop its hydropower resources. Some advocate that Nepal should harness as much of its potential 83,000 Megawatts (MW) of hydropower for local use, and export the surplus to other countries to generate revenue. Others argue that Nepal should only harness enough electricity for its own consumption and avoid exporting power since the environmental costs and risks of hydropower are so high.

The Nepal government’s white paper on the energy, water resources and irrigation sector aims to increase production capacity to 15,000MW. The current peak load electricity demand of Nepal is around 1,500 MW, according to the Nepal Electricity Authority (NEA). This is expected to increase to 2,379 MW by 2022 and 4,280 MW by 2030 in a business-as-usual scenario. But if there is reliable electricity for 24 hours per day then peak electricity demand would reach 2,744 MW by 2022 and 5,371 MW by 2030.

In addition, around 95% of households in Nepal have access to electricity, out of which around 60% of households are connected to the grid, 10% by community rural electrification schemes, 18% by off-grid electrification schemes and 7% by stand-alone solar systems. The increase in household energy demand under surplus energy scenario is yet to be explored but we can assume that it won’t skyrocket. However, it will take more than a decade for all the households to have access and consume around 1,250 kWh annual per capita.

In the past Nepal has suffered severe electricity shortages with almost 18 hours of power cuts during the winter season when river flows are low. Now, after importing around 300 MW from India, at least the city areas are not facing long power cuts. However, industries and rural areas still face power cuts. Hydropower projects currently under construction are expected to add 3,000 MW by 2020 and soon Nepal will be able to become an energy surplus country. Nepal should then seek to export its surplus energy. But is Nepal’s hydroelectricity still lucrative enough to export to its power hungry neighbours?

Shifting energy demand in South Asia

In Bangladesh, 90% of population had access to electricity in 2017/18. Present installed power generation capacity is around 15,300 MW and 660 MW is imported from India. The government plans to expand its capacity to around 24,000 MW by 2021. Demand is expected to reach up to 50,000 MW by 2040 under a business-as-usual scenario. Natural gas is the major source of electricity generation in Bangladesh, accounting for around 61% of power generated. The rapid depletion of natural gas is one of the biggest challenges for Bangladesh’s energy sector. Bangladesh needs to diversify its source for power generation by increasing the share of renewable energy and decreasing share of natural gas. But instead Bangladesh plans to build a large number of coal plants.

In 2017, India’s peak electricity demand was 162 GW, and it is expected to reach 226 GW and 299 GW by 2022 and 2027 respectively. The peak power demand in Indian states sharing a border with Nepal (Bihar, Uttar Pradesh and Uttarakhand) was 21 GW in 2017 and is expected to increase by 33 GW in 2022 and 45G W in 2027. India plans to increase power generation from renewables by 175 GW by 2022, which would make the energy mix 50% from renewable energy, and 50% from conventional sources.

India’s energy demand forecasts are overestimated, in contrast to Nepal and Bangladesh where forecasts are underestimated. The overestimation of 30-40% over the past two decades has led India to experience a 1.1% energy surplus and 2.6% peak energy surplus. India’s energy production increased by over 240% during the last decade; 87 GW of thermal capacity was commissioned in just five years from 2012 to 2017. Bihar and Uttar Pradesh, Indian states bordering Nepal, are yet to be 100% electrified but ongoing rapid installation of power plants and aggressive rural electrification expansion activities will soon help them achieve this. India’s has almost achieved its target for universal energy access. Though controversial, Indian Prime Minister Narendra Modi claimed that all the villages in India are electrified. Even if this ignores some details, they are like to be soon electrified under the rural electrification scheme.

Hydropower – the uneconomical option

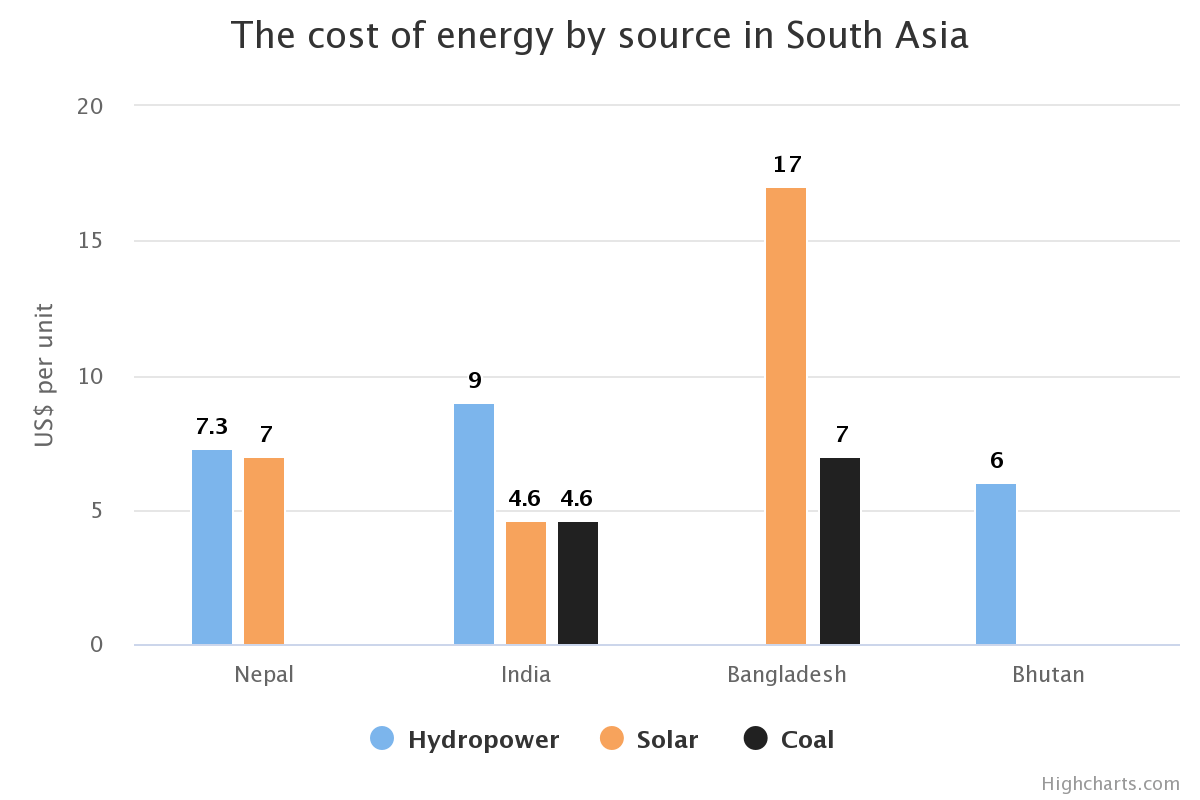

On the other hand, the power distribution companies in India are operating at a loss. There have been several government bailouts to clean up their finances over the past two decades. For the distribution companies, the surplus power means no more additional power is required. Even if they need power, they will the seek cheapest options i.e. either coal or solar. For hydropower, the estimated average cost per kilowatt-hour (kWh) in India is around 9 cents, compared to 7 cents in Nepal, and 6 cents in Bhutan. Coal and solar are much cheaper in India; it is only 4.6 cents per unit, almost half the cost of electricity generated by hydropower. For Bangladesh, the average the per unit energy generation cost from coal is around 7 cents.

The cost of power generation in India is much lower than in Nepal and Bangladesh. Even the production cost of renewable energy such as solar is lower in India. It is clear that from the Indian perspective it makes no economic sense to buy Nepal’s hydropower. For Bangladesh, investing in Nepal’s hydropower doesn’t look price competitive, but it will support the long term strategy of increasing the clean energy mix. However, Nepal alone cannot sell electricity to Bangladesh. It will need to sign an agreement to use India’s distribution system or to sell it to India and then to Bangladesh. Nevertheless, Nepal and Bangladesh has already signed a memorandum of understanding (MoU) for power exchange cooperation. But whether it can be implemented all depends on India.

A better way forward

It is clear that even under the high economic growth scenario Nepal won’t be able to consume 10,000 MW in the next decade and India’s rapid power generation plan and low cost renewables are making the Nepal’s hydropower less attractive in the region. Even if an MoU for regional energy trade is implemented in the near future, Nepal’s hydropower may not be attractive to the regional market as the cost of electricity is higher in Nepal compared to the India and Bangladesh. On the other hand, the cost of solar power is declining.

It is increasingly clear international investors are not interested in investing in large hydropower in Nepal because domestic electricity demand is not high, and the future for regional power and regulatory mechanisms are still unclear. Therefore, Nepal should instead focus on diversifying its energy mix by combining peak run-off-river and a medium sized storage hydropower, grid interconnection with renewables, upgrading the transmission and distribution system and reducing its energy loss.